3 State Sales and Use Tax Rates

There are only two sales taxes in Maine: a sales tax on purchases of tangible personal property and the “use tax.” Unlike the federal gas tax, the Maine use tax is assessed on the wholesale and retail value of the retail merchandise (including, for example, food).

The use tax applies to:

• Restaurants, except hot food (i.e., fried food) and drinks

• Grocery stores, drug stores, movie theaters, grocery trucks

• Restaurants operating on premises other than retail stores

• Fast-food outlets (other than “mom and pop” eateries)

• Hotels, lodging, or motels

• Stores that display merchandise in conjunction with other sales

• Certain recreational services, such as skiing, tennis, hunting, and shooting ranges

• Offices of hospitals, nursing homes, schools, etc.

A use tax rate is the rate at which the use tax is calculated and charged on sales of tangible personal property. The gross receipts tax (gross receipts) rate on the retail sale of tangible personal property is 3.75 percent, and the minimum sales tax rate on the retail sale of other properties is 0.25 percent. However, the retail sale of certain property exempted from retail sales tax is not subject to Maine use tax, including retail sales from manufacturers, farmers, and home-heating dealers.

4.3.1 The Retail Sales Tax Rate

The retail sales use tax rate is the same percentage amount as the gross receipts tax rate. This percentage applies to each sale, subject to certain exceptions. Certain sales are exempt from Maine use tax, including:

• Sales to a non-resident. Although the retail use tax is calculated based on the total retail sales price of the taxable merchandise, such sales are not subject to the gross receipts tax. For example, food and beverages that are sold to a restaurant, school, government entity, or retailer who is not located in Maine do not constitute retail sales for the purposes of the retail sales tax.

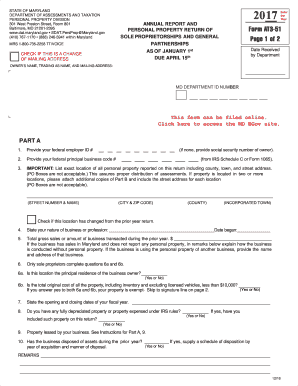

MD AT3-51 2013 free printable template

Show details

Dat.state. md. us 410 767-4991 888 246-5941 within Maryland MRS 1-800-735-2258 TT/VOICE ANNUAL PERSONAL PROPERTY RETURN OF SOLE PROPRIETORSHIPS AND GENERAL PARTNERSHIPS AS OF JANUARY 1 2013 DUE APRIL 15 2013 CHECK IF THIS IS A CHANGE OF MAILING ADDRESS Form AT3-51 Page 1 of 2 Date Received by Department OWNER S NAME TRADING AS NAME AND MAILING ADDRESS DEPARTMENT ID NO. STATE OF MARYLAND DEPARTMENT OF ASSESSMENTS AND TAXATION PERSONAL PROPERTY DIV...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form at3 51 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form at3 51 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form at3 51 2013 online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form at3 51 2013. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

MD AT3-51 Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form at3 51 2013 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your form at3 51 2013 into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I edit form at3 51 2013 on an Android device?

You can edit, sign, and distribute form at3 51 2013 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I fill out form at3 51 2013 on an Android device?

On Android, use the pdfFiller mobile app to finish your form at3 51 2013. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your form at3 51 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.